Explain Different Budgetary and Non Budgetary Control Techniques

2 Comparison of actual performance with budget. This study was carried out with the view to address two fundamental issues.

18 Budgetary Control Pdf Profit Accounting Budget

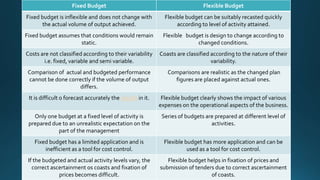

The 6 widely used budget setting techniques are.

. Among the most important of these are statistical data special reports and analysis analysis of break- even points the operational audit and the personal. In budgetary control we use following techniques. DIFFERENCE BETWEEN BUDGET AND FORECAST BASIS BUDGET FORECAST EVENTS It relates to planned events It is concerned with probable events PERIOD Planned separately for each accounting period May cover a long period or years COVERAGE Comprises the whole business unit It may cover a limited function CONTROL It is a tool of control It does not.

Ratio analysis and ROI iii. Traditional Types of Control Techniques in Management. The techniques for these non-budgetary control are.

Budgetary control is a continuous process which helps in planning and coordination. Taking the necessary action based on the monitoring results to ensure the budget remains within control. Checking accuracy of actual income and expenditure reported.

There are of course many traditional control devices not connected with budgets although some may be related to and used with budgetary controls. A month-to-month plan projects spending for the year and a quarter-to-quarter budget assists in preparing financial statements. Highlighting any variations to the budget owner.

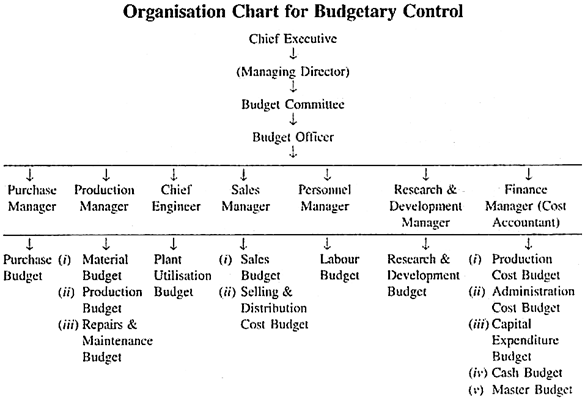

1 Establishment of objectives for each function and section of the organization. 1 incremental 2 activity-based 3 value proposition and 4 zero-based. The above definitions reveal the following essentials of budgetary control.

Budgetary controls are particularly useful in controlling performance in the areas of profitability and productivity. Budgetary control involves analyzing the results of the budget once you implement it. V Budgetary control helps to eliminate or reduce unproductive activities and minimising waste.

The key difference between budget and budgetary control is that budget is an estimation of revenues and costs for a period whereas budgetary control is the systematic process where management uses the budgets prepared at the beginning of the accounting period to compare and analyze the actual results at the end of the accounting period and to set. Four Main Types of BudgetsBudgeting Methods. Profits of a business enterprise depend very much on the cost of production.

Iv Budgetary control is a useful tool in profit-planning. Budgetary control is the process of preparation of budgets for various activities and comparing the budgeted figures for arriving at deviations if any which are to be eliminated in future. Financial ratio analysis.

For the sales budget following factors should take off into consideration. There are four common types of budgets that companies use. Non-Budgetary Control Techniques.

Budget and budgeting are the parts of planning whereas as budgetary control is linked with co-ordination control. In this technique we find variances. Break-Even point analysis.

Thus budget is a means and budgetary control is the end result. These techniques of non-budgetary controls are. Cost control includes techniques such as a Cost Accounting b Standard Costing and c Break-even point analysis.

Because of this cost accounting and cost control are given the much importance by the business concerns. The budgetary control process ensures funds are being. After this it is compared with actual accounting figures.

These techniques can be used independently or in combination depending on the type of budget implemented. First to determine if there is any association between budget budgetary. Variance Analysis First of all budgets of different departments are made with estimated figures.

A Past sales figures and trend b Salesmans estimates c Plant capacity d General trade prospects e Orders or hand f Proposed expansion of discontinuance of products h Potential market i Financial market. There are other means of control or non-budgetary controls in order to secure an effective and complete system of management controls. 3 Ascertainment of the causes for such deviations of actual from the budgeted performance.

Let us discuss them one by one. Zero-Base Budgeting Zero base budgeting is the latest technique of budgeting it has an increased use of management tools. Meaning Objectives Techniques StepsObjectives of Budgetary Control3 Types of Budgetary Controlling TechniquesFinancial BudgetsOperating BudgetsNon-monetary budgetsFixed and variable budgetsAdvantages and Disadvantages of BudgetingDifference between Budget and Budgetary ControlMaking Budgetary Control.

Comparing actuals with budgets. 1 Statistical data analysis. A three-year budget plan ensures that you manage expenditures over time.

Despite the emergence of modern techniques traditional practices are still widely in use these days. Meaning and Definition of Budgetary Control. 2 Break-even analysis or the no profit no-loss analysis.

You must adjust the long-term budget based on each yearly budget plan. These four budgeting methods each have their own advantages and disadvantages which will be discussed in more detail in this guide. Ii Budgetary control provides a yardstick against which actual results can be compared.

Three kinds of plans serve as a basis for budgetary control. Iii Budgetary control provides a clear definition of the objectives and policies of the concern. Types of Budgetary Control Sales Budget.

Budgetary Control Definitions Objectives Types Advantages And Limitations

Budget And Budgetary Control Notes Management Accounting Notes

Comments

Post a Comment